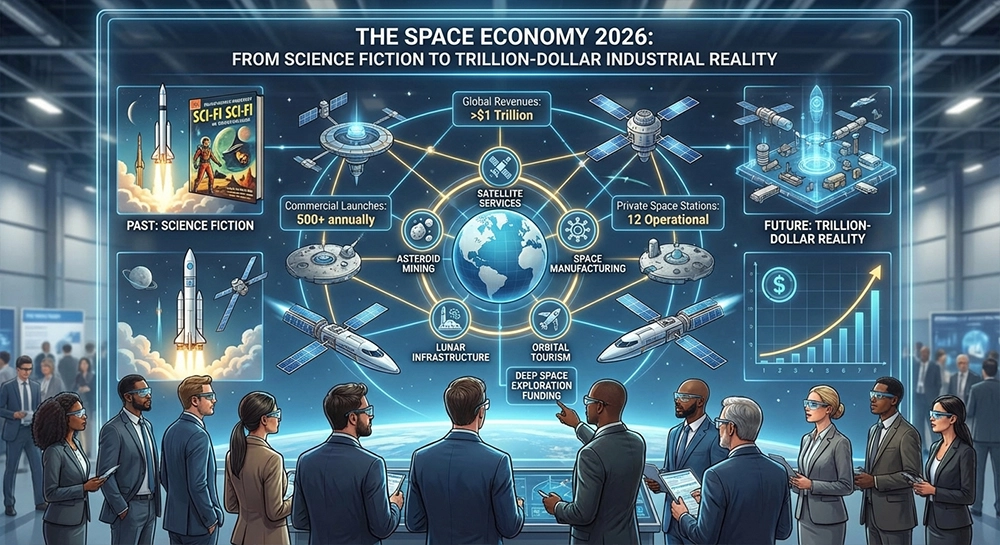

For decades, space was a domain of national prestige—a costly playground for superpowers planting flags and footprints. That era is dead. As we enter 2026, we have crossed the Rubicon into the Industrial Space Age. Space has evolved from a government-funded science project into a critical layer of the global economic stack, generating over $600 billion in annual revenue and growing at a double-digit clip.

This is no longer about billionaire tourism or Mars colonization dreams. It is about broadband internet, national security, precision agriculture, and pharmaceutical manufacturing. The "Space Economy" has decoupled from speculative hype and entered the deployment phase. Lower launch costs, driven by the relentless cadence of SpaceX's Starship, have unlocked business models that were mathematically impossible just five years ago.

The Starship Shock: The "Containerization" of Orbit

To understand the economics of space in 2026, you must understand the "Starship Singularity." After achieving reliable orbital insertion and recovery in late 2024 and 2025, SpaceX's mega-rocket has done for space transport what the shipping container did for global trade.

Cost-to-orbit has collapsed. In the Shuttle era, it cost $50,000 to put a kilogram into LEO. With Falcon 9, it dropped to $2,500. With Starship now operational, marginal costs are approaching $100 per kilogram. This 99% reduction in launch costs is a deflationary shock that changes everything.

Heavier Satellites: Engineers no longer need to spend millions miniaturizing components. They can launch massive, ruggedized satellites with huge power supplies and larger antennas, improving performance while cutting manufacturing costs.

Rapid Iteration: If a satellite fails, it's cheaper to launch a replacement than to spend five years ensuring 99.999% reliability. The "build, fly, fail, fix" cycle of Silicon Valley has finally reached orbit.

Mega-Constellations: Deployment of thousands of satellites is now routine. We aren't launching "a" satellite; we are launching "architectures."

The Space-for-Earth Economy: 3 High-Conviction Themes

1) Connectivity: The End of the Digital Divide

The "Direct-to-Cell" revolution is the biggest telecom story of the year. SpaceX (Starlink), AST SpaceMobile, and Lynk Global have activated constellations that act as cell towers in the sky. Standard smartphones—without special hardware—can now connect to satellites for text, voice, and basic data anywhere on the planet.

The Partnership Model: Carriers like AT&T and Verizon have realized they can't beat the satellites, so they are joining them. They are signing multi-billion dollar spectrum leasing deals to eliminate "dead zones."

Investment Implication: AST SpaceMobile (ASTS), having successfully deployed its BlueBird block-2 satellites, has transitioned from a speculative pre-revenue startup to a cash-flow generator.

2) Earth Observation (EO): The Planetary Bloomberg Terminal

If connectivity is about moving data, Earth Observation is about creating it. We are imaging the entire planet, every day, in every spectrum.

Hyperspectral Imaging: Companies like Pixxel and Planet Labs aren't just taking photos; they are analyzing chemical signatures. They can detect methane leaks from pipelines, measure moisture levels in cornfields, and identify camouflaged military vehicles.

Synthetic Aperture Radar (SAR): Companies like ICEYE and Capella Space use radar to "see" through clouds and at night. In a world of geopolitical conflict, the ability to track troop movements or port activity 24/7 is a product governments will pay any price for.

Palantir and BlackSky are merging this data with AI. In 2026, a hedge fund doesn't guess how many cars are in Walmart's parking lot; they buy a real-time feed counting them.

3) National Security: The "Proliferated" Defense

The U.S. Space Force has shifted its strategy from "Exquisite" (billion-dollar, school-bus-sized satellites) to "Proliferated" (hundreds of small, cheap satellites). The logic is simple: You can shoot down one $2 billion satellite. You can't shoot down 500 satellites that cost $5 million each and are replaced weekly.

Rocket Lab (RKLB): Once just a launch company, Rocket Lab has pivoted successfully to becoming a "Space Prime." They recently secured a $500 million contract to build and operate a constellation for the SDA.

L3Harris (LHX) and Northrop Grumman (NOC): The traditional defense primes have pivoted aggressively, acquiring space tech startups to secure their position in the new missile defense architecture.

Space Manufacturing: The "Killer App" Beyond Data?

In zero gravity, protein crystals grow larger and purer than on Earth. This allows for the creation of pharmaceutical formulations that are more potent and shelf-stable. Varda Space Industries has successfully returned multiple capsules from orbit containing Ritonavir crystals (an HIV drug).

While not yet a mass-market industry, big pharma giants like Merck and Eli Lilly are reserving capacity on commercial space stations for R&D. The thesis is that the next blockbuster drug might be discovered in a lab floating 400 kilometers above the Earth.

The Launch Market: It's SpaceX's World

SpaceX controls 85% of the global upmass. Their reliability and cadence are unmatched. Rocket Lab (Neutron rocket) and Blue Origin (New Glenn) are the only credible Western competitors entering service in 2025-2026.

Investment Implication: The "picks and shovels" play is better. TransDigm (TDG) and HEICO (HEI) make the specialized fasteners, valves, and avionics that go into every rocket, regardless of who launches it.

The Moon: The Next Geopolitical Flashpoint

The Artemis Program (NASA) and the ILRS (China) are in a race to the lunar south pole. Why? Water ice. Water can be split into hydrogen and oxygen—rocket fuel. Whoever controls the lunar water controls the gas station of the solar system.

Intuitive Machines (LUNR) has emerged as a leader here, successfully landing and operating on the lunar surface. While highly volatile, these stocks represent the "venture capital" end of the public market.

Risks: The Kessler Syndrome and Geopolitics

Orbital Debris (Kessler Syndrome): With 12,000+ satellites now in orbit, the risk of collision is rising. A chain reaction could render LEO unusable for decades. Startups like Astroscale are testing "tow truck" satellites to de-orbit dead junk.

Anti-Satellite Weapons (ASAT): Russia and China possess ground-based lasers and missiles capable of blinding or destroying satellites. A kinetic conflict in space would be an economic catastrophe.

Spectrum Wars: As thousands of satellites beam data down, radio frequency interference is becoming a major diplomatic issue.

Valuation and Portfolio Strategy

The "Industrial Space" Basket:

- Rocket Lab (RKLB): The "mini-SpaceX." Diversified revenue, reliable execution, and a growing backlog.

- Iridium Communications (IRDM): Profitable, dividend-paying, generating massive free cash flow from a monopoly on L-band satellite safety services.

- Planet Labs (PL): The leader in daily Earth scanning. Moving towards profitability.

The "Blue Chip" Exposure: Garmin (GRMN) is a massive beneficiary of satellite connectivity. John Deere (DE) uses precision GPS for autonomous tractors. You don't need pure-play space stocks to get exposure.

The ETF Route: ARK Space Exploration & Innovation ETF (ARKX) or Procure Space ETF (UFO) offer baskets. Active selection of individual high-conviction names is often superior in this sector.

Conclusion: The Final Frontier is Open for Business

In 2026, space has lost its novelty and found its utility. It is no longer a place we go to explore; it is a place we go to work.

The convergence of reusable launch (lowering barriers), miniaturized electronics (Moore's Law), and AI (data analysis) has created a flywheel of innovation that is spinning faster than regulators or competitors can catch up.

For the investor, the Space Economy represents the next great secular growth theme, comparable to the mobile internet in 2008 or cloud computing in 2012. We are moving from the infrastructure build-out phase to the application phase. The rails are laid (Starlink/Starship). Now, the empires will be built on top of them.

The sky is no longer the limit. It is the new basement of the global economy.